Service

Registration

GST Registration Online

- Price 999 /-

GST refers for Goods and Services Tax. It was introduced by the Prime Minister of India in an attempt to regulate prices throughout the country and remove all state or central Govt. imposed indirect taxes on goods and services by initiating GST Registration Online in India and New Company Registration in Chennai.

Whose businesses turnover exceeds above Rs. 20 lakhs is required to obtain their GST Number as a normal taxable person.

Apart for above New GST Registration is also mandatory for individuals or companies who are engaging themselves in the supply of goods or services across the state is required to apply GST Registration Online. Any One can GST Apply Online either as a normal taxpayer or under GST composition scheme Zone Tax India helps you for apply online GST Registration Form easily and also offer all startup business solution at very genuine cost. Obtain your online GST Registration at very reasonable cost by our professional experts.

The State taxes subsumed under GST

These are the few taxes which are implemented by state government VAT, Entry Tax, Central Sales Tax, Entertainment and Amusement Tax, Luxury Tax, Taxes on advertisements, Taxes on gambling, betting and lotteries related to the supply of commodities and services.

The GST Council, broadly approved GST rates for goods at nil rate,5%,12%,18% and 28% on certain goods.

DIFFERENCE BETWEEN CGST VS SGST VS IGST

When the supply of goods and services takes place WITHIN the State (Intra-state), that is when the Supplier and the Consumer both are in the same state, two taxes will be levied. One part is

levied by the State Government and the other is by Central Government. Hence the tax levied by the central government is known as Central GST.

State GST is the component of GST that will be collected by the state government on all items, both goods and services on intra-state trade.

When the supply of goods and services takes place BETWEEN two States (Inter-state), that is when the place of Supplier and the Consumer are in different states, Integrated GST is levied by

the central government. In case of Inter State supply of Goods and Services only IGST will be applicable.

DOCUMENTS FOR GST REGISTRATION

Pvt. Ltd. /Public Ltd. /OPC

- Company PAN card

- MOA, AOA & Incorporation Certificate

- Rental and EB Card

- Directors Photos 1Nos

- Directors PAN / Aadhaar Card

- Mobile No & Mail Id

- Nature of business

LLP & Partnership Firm

- Firm PAN card

- LLP Agreement/ Partnership deed

- Rental and EB Card

- Partners Photos 1Nos

- Partners PAN/Addhar Card

- Mobile No & Mail Id

- Nature of business

Proprietorship Firm

- Proprietor's PAN card

- Any One License

- Rental and EB Card

- Photos 1Nos

- Aadhaar Card

- Mobile No & Mail Id

- Nature of business

How to submit the document

- Please scan the documents and sent to zonetaxindia@gmail.com or whatsapp no: 9962005820

- Let us know your address by sent to this email. We will schedule a free document pick up based on the locations.

Time Duration: 03 to 5 Working Days

- Who having an annual aggregate turnover from all-India operations which is above the threshold limit of Rs.20 Lakhs and Rs.10 Lakhs for a special Category states is required to obtain GST registration.

- A Persons who Having Service Tax or VAT or Central Excise Registration.

- Who having business verticals in one state or branches in multiple states.

- Who making any kind of goods supply to other states.

- Required to pay tax under Reverse Charge its need when your supplier is not registered under GST).

- Agents of a supplier also need GST Registration.

- A Person Who Supplying goods or services through E-commerce Operator.

- E-commerce Operator / Aggregator who supplies goods or services online under his brand name such as Flip kart, Amazon, Ola.

- A Person Who is supplying online information and database access or retrieval services.

- GST registration helps entrepreneurs for starting new firm and opening of current account.

- GST registration helps in operating and managing better accounting of firm and company.

- GST helps businesses to sale and purchases of B2B & b2c business.

- It’s a very easy process and it takes less time to register as proprietorship firm.

- GST helps Less tax liability

- GST helps Limited compliances imposed

- GST helps Interstate sales without restriction

- GST helps Inter-state supply without restriction

- GST helps Easy Registration on e-commerce websites

- GST helps Competitive Advantages compared to other businesses

- GST helps Higher threshold limit for registration

- GST helps Facility of Composition Scheme

- GST helps Simple and easy online procedure

- Less number of complains

IE CODE REGISTRATION

- Price 1999 /-

Import Export or IE Code registration required for any one who are importing or exporting goods and services from India. IE Code is issued by the Directorate General of Foreign Trade (DGFT), Ministry of Commerce and Industries and Government of India. IE code is a 10 digit alphanumeric code. Once IE Codes issued it can be used by the entity throughout and its existence does not require for any renewal or filing. Therefore, it is recommended for most of organizations to obtain IE code who are importing or exporting goods and services from India. Mostly importers merchant can not import any goods without obtain IEC Code and also exporter merchant cannot take benefits from the DGFT Department for the export scheme etc.The banks require the importers IE Code while sending or receiving money abroad and also IE Code must be quoted by importers while clearing customs and sending shipment. Also.

DOCUMENTS FOR IE CODE REGISTRATION

Pvt. Ltd. /Public Ltd. /OPC

- Company PAN card

- MOA, AOA & Incorporation Certificate

- Rental and EB Card

- Company Address Proof

- Cancelled cheque of C/ A

- Directors PAN / Aadhaar Card

- Mobile No & Mail Id

LLP & Partnership Firm

- Firm PAN card

- LLP Agreement/ Partnership deed

- Rental and EB Card

- Firm Address Proof

- Cancelled cheque of C/ A

- Partners PAN / Aadhaar Card

- Mobile No & Mail Id

Proprietorship Firm

- Proprietor's PAN card

- Shop Act / Ghumasta License

- Rental and EB Card

- Address proof of Firm

- Cancelled cheque of C/ A

- Partners PAN / Aadhaar Card

- Mobile No & Mail Id

How to submit the document

- Please scan the documents and sent to zonetaxindia@gmail.com or whatsapp no: 9962005820

- Let us know your address by sent to this email. We will schedule a free document pick up based on the locations.

Time Duration: 01 to 02 Working Days

- IE Code helps you to expand your business from local market to international market and also helps to expand your product or service across the global.

- Once IEC Code issued under the DGFT for the lifetime validity so IE code holder does not require renew of any returns so it is a just a onetime cost of the registration.

- IE Code can be obtain by the individual person in their name who are proprietors. It is not necessary to set up a business for the same.

- IEC Code is issued for lifetime so it does not required for renewal.

MSME / SSI / UDYOG AADAR

- Price 499 /-

What is MSME / SSI / Udyog Aadar?

The registration under Micro, Small and Medium Enterprises Development (MSMED) Act, 2006 is for facilitating the promotion and development and enhancing the competitiveness of Micro, Small and Medium enterprises.

Though the MSME registration is not statutory, it is beneficial for business at it provides a range of benefits such as eligibility for lower rates of interest, excise exemption scheme, tax subsidies, power tariff subsidies, capital investment subsidies and other support.

Slabs for Micro, Small and Medium enterprises.

The following slabs have been prescribed under the MSMED Act to determine the status of the Enterprise:

| No | Type of Enterprise | Manufacturing Industry(Investment in Plant and Machinery) | Service Industry(Investment in Equipment's) |

|---|---|---|---|

| 1 | Micro | Does not exceed Rs.25 Lac | Does not exceed Rs.10 Lac |

| 2 | Small | Exceeds Rs.25 Lac but does not exceed Rs.5 Crore | Exceeds Rs.10 Lac but does not exceed Rs.2 Crore |

| 3 | Medium | Exceeds Rs.5 Crore but does not exceed Rs.10 Crore | Exceeds Rs.2 Crore but does not exceed Rs.5 Crore |

Advantages

- Lower rates of interest and FDI

- Excise exemption scheme

- Tax subsidies

- Power tariff subsidies

- Capital investment subsidies

Required Documents for MSME Registration

Pvt. Ltd. /Public Ltd. /OPC

- Company PAN card

- Bank A/C No & IFSC Code

- Name and Address

- Employees Details

- Directors PAN / Aadhaar Card

- Mobile No & Mail Id

- Nature of business

LLP & Partnership Firm

- Firm PAN card

- Bank A/C No & IFSC Code

- Name and Address

- Employees Details

- Partners PAN/Addhar Card

- Mobile No & Mail Id

- Nature of business

Proprietorship Firm

- Proprietor's PAN card

- Bank A/C No & IFSC Code

- Name and Address

- Employees Details

- Aadhaar Card

- Mobile No & Mail Id

- Nature of business

How to submit the document

- Please scan the documents and sent to zonetaxindia@gmail.com or whatsapp no: 9962005820

- Let us know your address by sent to this email. We will schedule a free document pick up based on the locations.

Time Duration: 01 to 04 Working Days

Trademark Registration

- Price 6999 /-

Trademark in India

The primary aim behind registering a trademark is to prevent other companies from infringing on the identity of your company. It stops them from manufacturing goods or services using your identifying mark.

Trademark laws may apply locally or internationally, depending on where you choose to register your mark. Although it is advisable to register your trademark early, there are situations where you can still get protection for an unregistered trademark.

With growing number of businesses and intense competition copyright piracy, trademark counterfeiting, and patent infringement have become significant problems in the business community. Certainly any small business that exports its IP protected products abroad or sources its products or parts overseas must take into account the potential for rampant IP theft in many countries. As a new organisation, it is absolute necessary to register your intellectual property through Patent / Copy Rights / Trade Mark.

- The Comprehensive Trademark Search, which will identify any potential conflicts with other trademarks.

- Written legal analysis of your Comprehensive Trademark Search results.

- Preparation and Filing of your Trademark Application personally by B-Perfect.

- Phone consultations regarding any issues pertaining to your Trademark Application.

Trademark registration under intellectual property India provides a business with several advantages that can help them competitively and legally.

It all starts with the right of ownership.

- You legally own the mark

- You can pursue legal action against infringers

- Your trademark will appear in searches

- Prevent against imported goods

- Easier path to international rights

- Use of ® symbol

Professional Tax Registration

- Price 2999 /-

Professional Tax Registration

DOCUMENTS FOR Professional Tax REGISTRATION

Pvt. Ltd. /Public Ltd. /OPC

- Company PAN card

- MOA, AOA & Incorporation Certificate

- Rental and EB Card

- Directors PAN / Aadhaar Card

- Mobile No & Mail Id

- Employees Details

- Property tax bill

LLP & Partnership Firm

- Firm PAN card

- LLP Agreement/ Partnership deed

- Rental and EB Card

- Partners PAN / Addhar Card

- Mobile No & Mail Id

- Employees Details

- Property tax bill

Proprietorship Firm

- Proprietor's PAN card

- Any one License

- Rental and EB Card

- Addhar Card

- Mobile No & Mail Id

- Employees Details

- Property tax bill

How to submit the document

- Please scan the documents and sent to zonetaxindia@gmail.com or whatsapp no: 9962005820

- Let us know your address by sent to this email. We will schedule a free document pick up based on the locations.

Time Duration: 05 to 08 Working Days

Following are the reasonable factors why should one never miss professional tax:

- Paying a professional tax is a judicial requirement and if any individual avoiding it can be reliable for the penalty or legal issues and self-employed individual and employer should also pay their professional tax depending on their rates or wages provided by their respective state within the prescribed time.

- Professional tax is simple and easy to comply with. Rules and regulations governing professional tax enforce minimal restrictions and it is very simple to get registered with uncomplicated monthly or annual compliances.

- The deduction can be laid claim of earlier paid professional tax.

- Being a state tax, the Professional tax a local tax authority’s obligation to get the professional tax deducted from fees of the professional, business income, and salary.

The Professional tax is applicable to the following class of individuals in states where they are working:

- HUF

- Individual

- One person Company/Private/Public

- Co-operative Society

- Body of Individuals

Association of Person

Individuals who fail to submit their professional tax is levied for the penalty. All states enforce a penalty for individual who is not registering professional tax even after it has become applicable. The amount of penalty for not submitting the professional tax varies from state to state. A penalty of Rs5/- a day is applicable on late in getting the registration of professional tax certificate. For non/late payment of profession tax, the penalty of 10% of the amount of tax with is imposed. In case of late filing of returns, an individual has to pay Rs.1000 of penalty and after a month, a penalty will be increased to Rs.2000.

EPF Registration

- Price 2999 /-

- Every establishment which is engaged in any one or more of the industries specified in Schedule I of the Act or any activity notified by Central Government in the Official Gazette. Employing 20 or more persons.

- Cinema Theatres employing 5 or more persons.

- Voluntary Coverage: If any of the establishment is not satisfying the above two conditions for coverage and if the employer and majority of the employees are willing, the Act may be applicable to such establishment.

- EPFO solicits cooperation of all establishments in ensuring a decent post retirement life for all workers & EPFO solicits advice and suggestions from employers and establishments in facilitating achievement of this goal.

- Enrolment of all eligible employees on its rolls (regular or contractual) – wages up to Rs.15,000/- at the time of joining the establishment.

- Have to deduct 12% contribution from Employees wages/salary (Basic+DA+retaining allowances if any) on monthly basis and it has to be remitted to EPF fund along with employer equal share.

- Confirm remittance status of contractual employees belonging to an EPF registered establishment before releasing payment to such contractors.

- Enroll employees drawing wages more than Rs.15,000/- if they so desire.

- Verify and confirm that all employees have KYC (Aadhaar, Bank Account and PAN) compliant UAN (Universal Account Number)

- The private EPF Trust seems to be more appealing as money remains with the in-house trust formed by the employer.

- The employees also gain from the tax benefits which were at par with the statutory provident fund scheme as well as speedier settlement of their claims on retirement/ resignation.

- Easy Availability of Advances.

- Getting DSC [DIGITAL SIGNATURE CERTIFICATE] for all Directors.

- No hassles of dealing with public departments.

- Availability of Refundable advances.

- Faster settlements

- Employee may get more interest

DOCUMENTS FOR EPF REGISTRATION

Pvt. Ltd. /Public Ltd. /OPC

- Company PAN card

- MOA, AOA & Incorporation Certificate

- Rental and EB Card

- Directors PAN / Aadhaar Card

- Mobile No & Mail Id

- Employees Details

LLP & Partnership Firm

- Firm PAN card

- LLP Agreement/ Partnership deed

- Rental and EB Card

- Partners PAN / Addhar Card

- Mobile No & Mail Id

- Employees Details

Proprietorship Firm

- Proprietor's PAN card

- Any one License

- Rental and EB Card

- Addhar Card

- Mobile No & Mail Id

- Employees Details

How to submit the document

- Please scan the documents and sent to zonetaxindia@gmail.com

- Let us know your address by sent to this email. We will schedule a free document pick up based on the locations.

Time Duration: 05 to 8 Working Days

ESIC Registration

- Price 2999 /-

An integrated need based social Insurance scheme

The promulgation of Employees’ State Insurance Act, 1948 envisaged an integrated need based social insurance scheme that would protect the interest of workers in contingencies such as sickness, maternity, temporary or permanent physical disablement, and death due to employment injury resulting in loss of wages or earning capacity. The Act also guarantees reasonably good medical care to workers and their immediate dependents.

BENEFITS

Digital Signature Certificate (DSC)

- Price 1499/-

These certificates are used in online participation/bidding in e-auctions and online tenders anywhere in India. The vendors who wish to participate in the online tenders must have a Class 3 digital signature certificate.

Following are the requirements for Applying for Digital Signature Certificate

- Submission of DSC Application form duly filled in by the applicant

- Producing Photo ID proof

- Producing Address proof

- Digital signatures are issued for 1 or 2 years. After their validity has expired, they need to be renewed

- A person can have different DSCs – one for official purpose and the other DSC for personal purpose

- Digitally signed documents are acceptable in legal courts as an evidence or proof

Agricultural and Processed Food Products Export Development Authority (APEDA)

- Price 9999/-

Agricultural and Processed Food Products Export Development Authority is an Apex-Export Trade Promotion Active government body set up by the Ministry of Commerce and Industry, Government of India under the Agriculture and Processed Food products Export Development Authority.

APEDA Registration Is Mandatory For All Exports Of Scheduled Products. Through APEDA Registration, An Exporter Can:

- Obtain guidelines on improving the packaging and marketing of the Scheduled Products to be exported.

- Attend training sessions conducted by APEDA in various aspects of the industries connected with the Scheduled Products.

- Get enlisted under the Exporters Directory available on the APEDA website.

Get brand publicity by advertising and promoting the products with the APEDA registration.

- Details of registered office, head office and branch office.

- Duly signed and sealed copy of application form.

- Self-certified copy of Import Export Code (IEC) issued by the Director-General of Foreign Trade.

- Bank certificate in the prescribed form to support the financial soundness of the applicant.

- Certified copy of MOA (in case of a company) or partnership deed (in case of partnership firm) or trust deed/Memorandum of Rules & regulations (in case of trust/society).

- Certified copy of MOA (in case of a company) or partnership deed (in case of partnership firm) or trust deed/Memorandum of Rules & regulations (in case of trust/society).

- Details of registration with other Export Promotion Council/Commodity Board, if any.

- Details of the licence issued by any sponsoring authority (DGTD, State Director of Industries etc.)

How to submit the document

- Please scan the documents and sent to zonetaxindia@gmail.com or whatsapp no: 9962005820

- Let us know your address by sent to this email. We will schedule a free document pick up based on the locations.

Time Duration: 05 to 08 Working Days

ISO Registration

- Price 7999/-

ISO registration is a registration process that is ideal for the purpose of increasing the quality and standard of the entity’s services or products.

ISO or the International Standard Organization certification provides believability and credibility to the organization. To maintain consistency and quality in this vast global marketplace, across all types of industries and nations, balances and checks need to be in one location. This certification ensures that the manufacturing process and the management system of the organisation hold all the needed requirements for calibration and quality assurance. ISO issues the certification to many types of industries such as energy management, medical devices and social responsibility. It is an independent association, non–governmental and international organization with about 164 members of national standard bodies.

The purpose of ISO certification is to certify certain standards and quality that will guarantee the safety, and efficiency of the services, products, and systems. ISO registration plays a vital role in many businesses as this certificate behaves or acts like a proof that the documentation process, the manufacturing process, service and management system of that particular business are concerning to all the requirements related to quality assurance and standardization.

ISO certificate is granted to many types of industries, from social responsibility and energy management to medical devices and risk management of the business. Each ISO certification holds a separate set of criteria and standard, and it is classified numerically. Such as ISO 9001:2015.

Registering with ISO 9001 certification is important for industries related food manufacturing units. This certification assures that the quality of the food products is maintained properly. ISO 9001 certification is mandatory from Small to the medium-sized manufacturer (SMM) and it is essential to measure their QMS. Owning a QMS allows you to make sure and to check on the irregularities for food safety and its standards and also helps in providing high-quality products by the entity.

- ISO certification plays a vital role in building credibility in the overseas business market if the company or entity is planning to expand its business internationally.

- Helps in improve customer satisfaction, as ISO standards aim to make organizations offer the best quality products and services to their customers.

- After getting the ISOcertification, the product must match the quality and standard of international standard; if it fails the product will face rejection due to quality issues.

- ISO certification is essential, even for government purposes such as to bid in tenders.

- Maintaining standards and quality in food products enhance the growth, cost savings and profitability, for SMMs.

Types of ISO Certificates

Documents Required for Online ISO Registration

- Passport size photographs

- Copy of PAN Card

- Copy of Adhaar card or Voter ID

- Sale Purchase Invoice copies

How to submit the document

- Please scan the documents and sent to zonetaxindia@gmail.com or whatsapp no: 9962005820

- Let us know your address by sent to this email. We will schedule a free document pick up based on the locations.

Registration Procedure to obtain ISO

- The applicant or the organisation has to make an application as directed by the ISO Certification body. And it must contain the rights and responsibilities of the business.

- Now, the authorized registrar will check the documents of quality manuals and all other documents such as policies and procedures of the company.

- Then, the Registrar will conduct an on-the-spot inspection, to examine or to check what all necessary changes are needed in the company.

In case, registrar observes anything that is not meeting the specified requirement of ISO standards, it is the responsibility of the business owner to come out with a plan to execute to eliminate all the flaws of the entity. The action plan needs to hold the complete and detailed list of all the tasks which are needed to be performed.

Company Registration

PRIVATE LIMITED REGISTRATION

- Price 9999/-

Private Limited Company

Private limited company is the most popular option for start-ups and emerging businesses in India which gives competitive advantage to attract the Venture Capitalists. DIN, DSC, Name Approval, MOA, AOA, Incorporation Certificate, PAN and TAN.Best New Company Registration in Chennai.

- Limited by shares i.e. a company having the liability of its members limited by the memorandum to the amount, if any, unpaid on the shares respectively held by them

- Having a minimum paid-up share capital as may be prescribed, and which by its articles

- Limits the number of its members to Two Hundred.

- Attract Investors and FDI

- Flexibility & Easy Expansion for better growth

- Separate Legal Entity

- Gain Confident in Brand Promotions & Branding

- No of Director’s PAN Card

- Director’s passport size photo-2 Nos

- Director’s Aadhar Card

- Director’s Mobile No & Mail Id

- Rental Agreement & EB Card

- Company Name & Address

- Nature of Business

- Initial level discussion between the Promoters and Zonetax

- Ascertaining documents required and availability.

- Preparation and signing of documents.

- Getting DSC [DIGITAL SIGNATURE CERTIFICATE] for all Directors.

- Getting DIN [DIRECTOR IDENTIFICATION NUMBER] for all Directors.

- Preparing MOA and AOA.

- SPICe(INC-32) Filing i.e. Incorporation of the company.

Company PAN & TAN.

How to submit the document

- Please scan the documents and sent to zonetaxindia@gmail.com or whatsapp no: 9962005820

- Let us know your address by sent to this email. We will schedule a free document pick up based on the locations.

Time Duration: 05 to 08 Working Days

What are the Requirements for a Pvt Ltd Company Registration?

LIMITED LIABILITY PARTNERSHIP

- Price 9999/-

The Limited Liability Partnership concept is introduced in India by way of the Limited Liability Partnership Act, 2008A Limited Liability Partnership combines the advantages of both the Company and Partnership into a single form of organization with low compliance cost. LLP has all time a beneficial entity from Income Tax point compared to other forms of entities and thus it carries special advantages for new startups in LLP. LLP is one of the easiest form of business to incorporate and manage. LLP have very little compliance to fulfill, in comparison to private limited companies

A Limited Liability Partnership business is required to file an Annual Return within 2 months of the closing of the financial year.The return needs to be filed with Form 8 and Form 11 with the Registrar of Companies (RoC).

- Attract Investors and FDI

- Flexibility & Easy Expansion for better growth

- Separate Legal Entity

- Gain Confident in Brand Promotions & Branding

- No of Partner’s PAN

- Partner’s passport size photo-2 Nos

- Partner ‘s Aadhar Card

- Partner’s Mobile No & Mail

- Rental Agreement & EB Card

- Company Name & Address

- Nature of Business

How to submit the document

- Please scan the documents and sent to zonetaxindia@gmail.com or whatsapp no :9962005820

- Let us know your address by sent to this email. We will schedule a free document pick up based on the locations.

Time Duration: 05 to 08 Working Days

Limited Liability Partnership Registration Requirements

ONE PERSON COMPANY

- Price 8999/-

One Person company is a new concept in India introduced in the Companies Act, 2013. One of the advantages of a OPC is that there can be only one member in a OPC, while a minimum of two members are required for incorporating and maintaining a Private Limited Company or a Limited Liability Partnership. OPC formation will be same as Private limited company, except in the name of the company OPC must be included. Only a natural person who is an Indian citizen and resident in India shall be eligible to act as a member and nominee of OPC. If an OPC hits a turnover crosses Rs. 2 crores, it should be converted into a private limited company or public limited company.

What is One Person Company (OPC) Registration?

- No of Director’s PAN Card

- Director passport size photo-2 Nos

- Director Aadhar Card

- Director Mobile No & Mail Id

- Rental Agreement & EB Card

- Company Name & Address

- Nature of Business

How to submit the document

- Please scan the documents and sent to zonetaxindia@gmail.com or whatsapp no: 9962005820

- Let us know your address by sent to this email. We will schedule a free document pick up based on the locations.

Time Duration: 05 to 08 Working Days

Process

We help you with the post-registration formalities and compliances.

One Person Company Registration Requirement

Partnership Firm

- Price 3499/-

What is Partnership Firm?

- Require Documents Address & ID proof of Director & Nomine

- Address Proof of registered office – Address proof of proposed registered office for registration of company.

- Easy to form

- Flexible in operation

- Less compliance

- Relatively inexpensive

- Initial level discussion between the Promoters and Zonetax Team.

- Ascertaining documents required and availability.

- Preparation and signing of documents.

- Preparation of Partnership Deed

- Registration of Partnership Firm i.e. Form “C” Company PAN & TAN

Advantages of Partnership Firm Registration

Disadvantages of the Partnership Firm Registration

The liabilities of partners of the partnership firm are not limited which is the biggest drawback for the partners of the firm. In case of any other misfortune or debt, the personal assets of the partners can be used to clear the loans or issues or debts.

Limitation in the maximum number of members, yes, the maximum number of partners is limited to 20 in the Partnership Firm.

Society Registration

- Price 9999/-

A Society is generally formed when a group of individuals come together with a common objective of serving the society. In order to become a registered legal entity, a Society must register under The Societies Registration Act, 1860. Society Registration, under, The Society Registration Act, in India, lays down certain procedures for the sake of society registration & operation. This act was implemented with the purpose of augmenting the legal stipulations of society registration for the advancement of literature, fine arts, science or distribution of awareness for bountiful purposes. The society registration act, 1860 has been accepted by several state governments without or with further amendments. A society exists for the purpose of charitable activities such as poverty relief, arts, education, religion, cultures and sports. The Governing body members are entrusted with the management of the affairs of the society. Even Non-Indian citizens can be a part of the Societies in India.

For a society registration, the mentioned below documents are needed:

- The Society name

- Address proof of the registered office.

- Identity proof of all the members of the company which can be:

- Aadhaar card

- Copy of Passport

- Driving License

- Voter ID

- Two copies of the MOA and By-laws as per the specified norms for the society registration.

How long will it take?

Submission of Basic Info & Documents – One – Two Days

Drafting Memorandum of Association

Two – Three Days

Drafting Bylaws – Two – Three Days

Registration – one day

How to submit the document

- Please scan the documents and sent to zonetaxindia@gmail.com or whatsapp no: 9962005820

- Let us know your address by sent to this email. We will schedule a free document pick up based on the locations.

Tax Return

TDS Return Forms - 24Q, 26Q, 27Q & 27EQ

- Price 999/-

Tax Deducted at Source or TDS is a type of advance tax which is deducted from the earnings of an individual or an organization before the money is actually credited into that entity’s account, according to the Indian Taxation Code. The government is able to generate revenues by implementing the provisions of TDS on the earnings of individuals as well as businesses. Rules and regulations regarding TDS are controlled and governed under the Income Tax Act, 1961 by the Central Board of Direct Taxes (CBDT)

As the name suggests, “Tax Deducted at Source” implies that the payee or the employer deducts the tax before making a payment to the receiver. Tax Deducted at Source is applicable on income earned regularly and also on the income earned occasionally or irregularly. Thus, TDS is applicable on various incomes, including, but not limited to Salary, Commission, Rent, Professional Fees and Interest.

Advantages of payment of TDS

TDS is payable on the earnings so it is important to note that the liability to pay TDS is applicable only in the event of earnings actually taking place. TDS is deducted before making payments. Deductions are to be made on payments that are made in cash, cheque or credit. The amount deducted under TDS is further deposited with various government agencies.

Payment of TDS has various advantages which are as follows:

- Deducting TDS at source prevents tax evasion.

- Tax collection is done duly and in a timely manner.

- A large number of people come under the tax net.

- Collection of TDS is a steady source of revenue for the government.

- Individuals

- Hindu Undivided Family

- Limited Companies

- Partnership Firms

- Body of Individuals

- Association of Individuals

- Local Authorities

Penalty on late filing of ITR

As per the new law from this year, Individuals will have to pay late fee after last date to file income tax return for the FY 2018-19

- Rs 5000 if tax is filed after due date of 31st Aug but on before 31 December of that assessment year (in this case 31 December 2019)

- Rs 10,000 if tax is filed after 31 December but on or before 31 March of the relevant assessment year (in this case from 1 January to 31 March 2020

But, there is relief to small taxpayer, IT Department has stated if your total income does not exceeds 500,000 , then maximum penalty of Rs 1000 will be levied on delay of ITR filing.

ITR-1 form is an essential x form [Income Tax Return form] for Indian citizens filing their tax returns with the Income Tax Department. This form is issued by the Income Tax Department of India and is an integral part of the rules laid down by the Government of India for filing Income Tax Returns.

Eligible individuals for ITR-1 SAHAJ (Hindi terminology meaning ‘easy’

Individuals who have earned their Income for a Financial Year only through the following means are eligible to fill the ITR-1 SAHAJ form.

- Through Salary or Pension

- Through One House Property (except in case of losses brought forward from preceding years)

- Through other sources apart from Lottery, Racehorses, Legal Gambling etc. Other sources include FD interest, spousal pension etc.

In case of clubbed Income Tax Returns, where a spouse or a minor etc. is included in the tax returns, this can be done only if their income too is limited to the specifications laid down above

- Earning Income through a salary or pension

- Income through House Property.

- Earning Income through capital gains (Short Term and Long Term)

- Earnings through Other Sources (includes Income through Lottery Winnings, through bets on Racehorses, and other Legal methods of Gambling)

The ITR-3 Form particularly applies to those Individuals and Hindu Undivided Families who are registered as Partners in a firm. As per Rule 12 of the Income Tax Rules, 1962, this form does not apply to those who are Proprietors of a firm. It is mainly for the business which includes partnership deals. It is also applicable for professionals but it should be a partnership profession.

Eligible Assessees for the ITR-3 Form

The eligibility criteria of every Income Tax Return form are governed by a set of rules and conditions. The ITR-3 Form is applicable only to those Individuals and Hindu Undivided Families that can be placed under the following categories

- Is a Partner in a firm

- Gains Income through ‘Profits or gains of business or profession’

- Gains Income by means of interest, salary, bonus, commission, remuneration, as a partner

If the partner of a firm only earns income from the firm as a share in the profits and not by any other means such as interest, bonus, salary, remuneration, or commission etc. then such an Individual or Hindu Undivided Family should file Income Tax Returns using only the ITR-3 Form, and not the ITR-2 Form.

Non-eligible Assessees for the ITR-3 Form

Individuals and Hindu Undivided Families who are not eligible to fill the ITR-3 Form are those who have earned Income through a Business or Profession operated as a Proprietorship firm.[8] Assessees, who apart from being a partner in a firm, also have sources of income from a business or profession, including the speculation market, are also not eligible to file their Income Tax Returns through this form.

The ITR-4 Form is applicable to those individual and Hindu Undivided Families who want to declare their income from Business or Profession under Presumptive Income Scheme of Income Tax under Section 44AD ,Sec 44ADA and Section 44AE of the Income Tax Act.

- PAN Card

- Aadhar Card

- Bank Statement F.Y.

- Last Year IT Filing Copies- For Existing User

- Loan Statements if any like:

- Personal Loan

- Business Loan

- Vehicle Loan

- Housing Loan & Other Loans etc.

- Deductions:

- Tuition Fees

- LIC Premium

- Mediclaim

- Asset details:

How to submit the document

- Please scan the documents and sent to zonetaxindia@gmail.com or whatsapp no: 9962005820

- Let us know your address by sent to this email. We will schedule a free document pick up based on the locations.

How Long Will It Take?

Upload Required Documents – One Day

Preparing Your Return -Two – Three Days

Payment of Tax – One Day

Filing Your Return -Same Day

GST Return

- Price 499/-

What Is GST Return?

- Purchases

- Sales

- Output GST (On sales)

- Input tax credit (GST paid on purchases)

Who should file GST Returns?

What are the different types of GST Returns?

Due dates for All GST Returns

| Return Form | Particulars | Frequency | Due Date |

| GSTR-1 | Details of outward supplies of taxable goods and/or services affected | Monthly | 11th* of the next month with effect from October 2018 *Previously, the due date was 10th |

| GSTR-2 Suspended | Details of inward supplies of taxable goods and/or services affected claiming the input tax credit. | Monthly | 15th of the next month |

| GSTR-3 Suspended | Monthly return on the basis of finalization of details of outward supplies and inward supplies along with the payment of tax. | Monthly | 20th of the next month |

| GSTR-3B | Simple Return in which summary of outward supplies along with Input Tax Credit is declared and payment of tax is affected by taxpayer | Monthly | 20th of the next month |

| GSTR-4 | Return for a taxpayer registered under the composition levy | Quarterly | 18th of the month succeeding quarter |

| GSTR-5 | Return for a Non-Resident foreign taxable person | Monthly | 20th of the next month |

| GSTR-6 | Return for an Input Service Distributor | Monthly | 13th of the next month |

| GSTR-7 | Return for authorities deducting tax at source. | Monthly | 10th of the next month |

| GSTR-8 | Details of supplies effected through e-commerce operator and the amount of tax collected | Monthly | 10th of the next month |

| GSTR-9 | Annual Return for a Normal Taxpayer | Annually | 31st December of next financial year* |

| GSTR-9A | Annual Return a taxpayer registered under the composition levy anytime during the year | Annually | 31st December of next financial year* |

| GSTR-10 | Final Return | Once, when GST Registration is cancelled or surrendered | Within three months of the date of cancellation or date of cancellation order, whichever is later. |

| GSTR-11 | Details of inward supplies to be furnished by a person having UIN and claiming a | Monthly | 28th of the month |

Late Fees and Interest on GST Return

Late fees and Interest forms important components of the GST payment and is incurred by business in case of delay in submitting or filing GST returns. The article covers all latest announcements on Late fees and Interest charge in a comprehensive manner

All about Late Fees under GST

As per GST laws, the Late Fee is an amount charged for delay in filing GST returns. It can be referred to as an overdue fine.

When a GST Registered business misses filing GST Returns within the prescribed due dates*, some amount of late fees is charged. The late fee is also applicable for the delay in filing NIL returns. For example, there are no figures to declare for sales or purchases for the month of December 2018 in the GSTR-3B. Still, this return must be filed.

The amount will depend upon the number of days of delay from the due date. GST return in GSTR-3B is filed on 23rd January 2019, 3 days after the prescribed due date i.e 20th January 2019. Late fees will be calculated for three days and deposited in cash.

However, currently, the GST portal is aligned to charge a late fee only on returns GSTR-3B, GSTR-4, GSTR-5, GSTR-5A, GSTR-6, GSTR-8, GSTR-7 and GSTR-9 only.

| Name of the Act | Reduced Late fees for every day of delay |

| CGST | Rs 25 |

| SGST | Rs 25 |

| Total Late fees to be paid | Rs 50 |

Professional Tax Return

- Price -1999/-

What is the Purpose of Levying Professional Tax?

The reason for levying any sort of tax by the government is to generate revenue in order to build robust infrastructure, pay government workers like police personnel, firefighters; ensure defence of the country, etc. Besides that, the government uses these funds for public welfare programs including child development and women’s welfare schemes. There are many different types of taxes that are imposed on the citizens e.g. income tax, capital gains tax, corporate tax, customs duty, etc. A common direct tax imposed by the state government is the professional tax.

Professional Tax is dependent on the gross income of professionals and salaried people. It is deducted from the salaries of all employees each month. When it involves a company, directors of the company, partnerships, individual partners, self-employed and businesses, it is deducted from the gross turnover of the company recorded in the previous year. In certain cases, the disbursement of tax is preset and is to be paid irrespective of what the turnover is. The slab for professional tax varies in each state across India.

- Application of registration should be made to the assessee’s state tax department within 30 days of employing staff

- Mandatory Registration of employees within 30 days of employment should be done

- The professional tax amount will be deducted from the salary of the employee

- In the case of 20-plus employees, the payment should be made within 15 days from the month end

- If there are less than 20 employees, payment should be made every quarter of the year

- In case the assessee has multiple places of work, then applications should be sent to each authority under its respective jurisdiction

- The last date for filing of profession tax returns in Tamil Nadu is the last day of September and the last day of March i.e. twice a year.

Who Gets Exemption from Professional Tax in Tamil Nadu

The following is a short list of individuals who are exempted from the profession tax in Tamil Nadu:

- Anyone who is above 65 years of age

- Guardians or parents of children with mental disability

- Women agents involved exclusively under the Director of Small Savings or Mahila Pradhan Kshetriya Bachat Yojana

- People who have a permanent physical disability, including blindness

- Textile industry Badli workers

- Military personnel of the forces as delineated under the Air Force Act 1950, the Navy Act 1957 and the Army Act 1950 plus members of the auxiliary forces or reservists working for the state

Professional Tax in Tamil Nadu

Tamil Nadu is one of the relatively small number of states in India that actually levies profession tax on its citizens. Anyone who gets a salary or any sort of income would come under the profession tax structure. For complete understanding of who all come under the profession tax and how it is levied, you can visit the official government website http://www.tn.gov.in/dtp/professional-tax.htm. This tax is compulsory, but you can claim the income tax deduction on the amount paid as profession tax. Constitution of India Article 276 states that the total amount payable as profession tax should not exceed Rs. 2500. The registration process for professional tax in Tamil Nadu can be completed online.

Revised Professional Tax in Tamil Nadu

The slab of the profession tax has been revised for Tamil Nadu in the year 2018. Now, it involves a new provision of tax on employment and calling as well as professions and trades. Profession Tax for the following categories will be calculated on a half-yearly basis:

• Companies

• Salaried people (State & Central Government)

• Private Establishments

As per the Tamil Nadu Municipal Laws Second Amendment Act 59 of 1998, section 138 C, “Any individual occupied in any trade, profession, employment and calling in the city limits of the Corporation of Greater Chennai, will have to pay the half-yearly Professional Tax. It will be calculated based on the gross income that is declared half-yearly as follows:

| Average Monthly Income (Half-yearly/Rs.) | Revised Professional Tax (Half-yearly/Rs.) |

| Up to 21,000 | NIL |

| 21,001 to 30,000 | 135/- |

| 30,001 to 45,000 | 315/- |

| 45,001 to 60,000 | 690/- |

| 60,001 to 75,000 | 1025/- |

| 75,001 and above | 1250/- |

Documents Required for Professional Tax Registration in TN:

The following is the list of documentation required for the registration process under profession tax rules of Tamil Nadu:

- Shops and Establishment Trade License Copy/Registration Certificate

- Lease Agreement

- PAN Card

- Articles of Association

- Memorandum of Association & Incorporation Certificate

These requirements are subject to periodic change as per directions provided by the Tamil Nadu state government.

Tamil Nadu Professional Tax Payment Procedure

Property tax should be paid within 15 days from the commencement of half-year i.e. the month of September and March.

- Payment can be made to all zonal offices of the respective municipal authority within the state of Tamil Nadu by cheque or demand draft.

ROC Filing

- Price 6999/-

Every company is required to file the annual accounts and annual return as per The Companies Act, 2013 within 30 days and 60 days respectively from the conclusion of the Annual General Meeting. The ROC filing of annual accounts is governed under Section 129(3), 137, of The Companies Act, 2013 read with Rule 12 of the Company (Accounts) Rules, 2014 and annual return is governed under Section 92 of the Companies Act,2013 read with Rule 11 of the Companies

The procedure of ROC filing the annual return and annual accounts can be easily understood by the following process:

- Hold a Board Meeting to

- Authorize the auditor for the preparation of financial statements as per Schedule III of the Companies Act, 2013.

- Authorize the Director or Company Secretary for preparation of Board Report and Annual Return as per the Companies Act, 2013.

- Hold another Board Meeting for approving the draft financial statements, Board Report and Annual Return by the directors of the company.

- Conduct the Annual General meeting of the Company and pass the necessary resolutions. Please note that the financial statements are considered final only when the same is approved by the shareholders at the General Meeting.

- Incorporation Document Certificate of Incorporation, PAN Card, and MoA and AoA of Private Limited Company

- Audited Financial Statements Financial Statements should be audited by the independent auditor

- Board Report and Audit Report Independent auditor’s report and Board report is also required

- DSC or Digital Signature Certificate of Director Valid and active Digital Signature Certificate or DSC of one of the directors must be submitted

Benefits of Annual Compliance

License

SHOPS & ESTABLISHMENT LICENSE

- Price 3999/-

The Tamil Nadu Shop and Establishment Act applies to all shops and commercial establishments as defined above. However, the following persons or types of establishments will NOT come under the purview of the Tamil Nadu Shop and Establishment Act:

- Persons employed in any establishment in a position of management

- Persons whose work involves traveling and persons employed as canvassers and caretakers

- Establishments under the Central and (State) Government, Local Authorities, the Reserve Bank of India, and Cantonment Authorities d) Establishments in mines and oil fields

- Establishments in bazaars in places where fairs or festivals are held temporarily for a period not exceeding fifteen days at a time

- Establishments which, not being factories within the meaning of the Factories Act, 1948 are in respect of matters dealt within this Act, governed by a separate law for the time being in force in the (State)

Further, the regulations relating to opening and closing hours of shops, and grant of holidays will not apply to hospitals, institutions for the treatment or care of the sick, chemists or druggists shops as specified by time to time by the State Government.

DOCUMENTS FOR SHOP ACT REGISTRATION

Pvt. Ltd. /Public Ltd. /OPC

- Company PAN card

- MOA, AOA & Incorporation Certificate

- Rental and EB Card

- Employees Details

- Directors PAN / Aadhaar Card

- Mobile No & Mail Id

- Nature of business

LLP & Partnership Firm

- Firm PAN card

- LLP Agreement/ Partnership deed

- Rental and EB Card

- Employees Details

- Partners PAN/Addhar Card

- Mobile No & Mail Id

- Nature of business

Proprietorship Firm

- Proprietor's PAN card

- Any One License

- Rental and EB Card

- Employees Details

- PAN/Aadhaar Card

- Mobile No & Mail Id

- Nature of business

How to submit the document

- Please scan the documents and sent to zonetaxindia@gmail.com or whatsapp no: 9962005820

- Let us know your address by sent to this email. We will schedule a free document pick up based on the locations.

Time Duration: 03 to 5 Working Days

- Cleanliness: The premises of every establishment must be kept clean and free from effluvia arising from any drain or privy or other nuisance and should be cleaned at regular intervals.

- Ventilation: The premises of every establishment must be well ventilated.

- Lighting: The premises of every establishment must be sufficiently lighted during all working hours.

- Precautions against fire: In every establishment, precautions must be taken against fire.

Person employed in any shop or establishment shall be entitled, after twelve months of continuous service with the establishment, to holidays with wages for a period of 12 days in the subsequent period of twelve months.

- Any shop or commercial establishment that commences operation must apply to the local municipality / corporation office within the prescribed time.

- The application for license in the prescribed form must contain the name of the employer, address of the establishment, name of the establishment, category of the establishment, number of employees and other relevant details as requested.

- The license must be prominently displayed at the shop or commercial establishment and renewed periodically, as per the act.

In case the shop or establishment would like to close down the business, the occupier should notify to the state / corporation / municipal authorities

TRADE LICENSE

- Price 2999/-

- All Business entities.

- All shops, commercial establishments, restaurant, hotel, theatre, public amusement, and retail trade/business.

- Registrations and renewals are subject to the state act.

- Visit the Tamil Nadu Government’s official website and procure Form-1 along with the fee payment.

- Fill all the details in the Form that includes the personal information of the applicant, the purpose of trade and Tax details.

- Filing the application to the Commissioner.

- After submission of the application, the Commissioner will analyze and inspect the application and if he/she is satisfied with all the needed documents, a fee payment should be paid, after which the licence will be issued within in a time period of 1 week.

As obtaining the trade license, the renewal the form is also mandatory and it can be filed by March 1st in Municipalities, and 45 days prior to the end of the year in specified Corporation zones.

DOCUMENTS FOR TRADE LICENSE REGISTRATION

Pvt. Ltd. /Public Ltd. /OPC Firm

- Company PAN card

- MOA, AOA & Incorporation Certificate

- Rental and EB Card

- Directors Photos 1Nos

- Directors PAN / Aadhaar Card

- Mobile No & Mail Id

- Nature of business

- Property tax bill

LLP & Partnership Firm

- Firm PAN card

- LLP Agreement/ Partnership deed

- Rental and EB Card

- Partners Photos 1Nos

- Partners PAN/Addhar Card

- Mobile No & Mail Id

- Nature of business

- Property tax bill

Proprietorship Firm

- Proprietor's PAN card

- Any One License

- Rental and EB Card

- Photos 1Nos

- PAN/Aadhaar Card

- Mobile No & Mail Id

- Nature of business

- Property tax bill

How to submit the document

- Please scan the documents and sent to zonetaxindia@gmail.com or whatsapp no: 9962005820

- Let us know your address by sent to this email. We will schedule a free document pick up based on the locations.

Time Duration: 05 to 10 Working Days

Food Safety And Standards Authority Of India (FSSAI)

- Price 1999 /-

Every food manufacturing or processing or packaging or distributing entity is now required to obtain a FSSAI License.

Food Safety and Standards Authority of India (FSSAI)

The Food Safety & Standards Act, 2006 introduced to improve the hygiene and quality of food has brought about tremendous changes in the food industry. As per the Act, no person shall commence or carry on any food business except under a FSSAI license or FSSAI registration. Therefore, any food manufacturing or processing or packaging or distributing entity is now required to obtain a FSSAI License.

There are 3 kinds of FSSAI Licenses – Basic, Central, and State. Every food business must register for an FSSAI License under the Food Safety and Standards Act, 2006. Zonetax helps you register for an FSSAI License in 3 simple ways –

Every Food Business Operator is required to be licensed/registered under the FSSAI. FSSAI Registration is required by small businesses like hawkers, petty retailers, etc whose annual turnover is less than Rs.12 lakhs per year. All food businesses exceeding this annual turnover limit of Rs 12 lakhs per year require a FSSAI License.

Whether you are a small scale or large scale business, you need to obtain FSSAI State License or FSSAI Central License, according to your requirement. Usually, large manufacturers, exporters, importers, etc obtain Central Licence while mid-sized entities like transporters, traders, etc need State Licence.

DOCUMENTS FOR FSSAI REGISTRATION

Pvt. Ltd. /Public Ltd. /OPC

- Company PAN card

- MOA, AOA & Incorporation Certificate

- Rental and EB Card

- Any one Govt Certificate

- Directors PAN / Aadhaar Card

- Mobile No & Mail Id

- Nature of business

- Property tax bill

- Directors Photos 1Nos

LLP & Partnership Firm

- Firm PAN card

- LLP Agreement/ Partnership deed

- Rental and EB Card

- Any one Govt Certificate

- Partners PAN/Addhar Card

- Mobile No & Mail Id

- Nature of business

- Property tax bill

- Partners Photos 1Nos

Proprietorship Firm

- Proprietor's PAN card

- Any One License

- Rental and EB Card

- Any one Govt Certificate

- PAN / Aadhaar Card

- Mobile No & Mail Id

- Nature of business

- Property tax bill

- Photos 1Nos

SPICES BOARD REGISTRATION

- Price 2499 /-

WELCOME TO SPICES BOARD INDIASpices Board (Ministry of Commerce and Industry, Government of India) is the flagship organization for the development and worldwide promotion of Indian spices. The Board is an international link between the Indian exporters and the importers abroad. The Board has been spearheading activities for excellence of Indian spices, involving every segment of the industry. SPICE BOARD CERTIFICATE (CRES)The Spices Board of India issues the CRES, which stands for Certificate of Registration as an Exporter of Spices. The certificate authenticates that an exporter of scheduled spices is registered with a regulatory agency authorized by the Government of India. SPICE BOARD CERTIFICATE VALIDITYThe Spices Board issues certificates for a three-year block term. At the conclusion of each block year, the certificate should be renewed. If you acquired a certificate valid from 2017 to 2020, for example, you must renew your registration certificate by the end of 2020. 2021-2024 is the current block year. |

Documents Required for Spice Board Registration

- Application in the prescribed form (Form-1)

- Self-attested copy of IE(import-export) codecertificate

- Registration fee in the form of crossed Demand Draft favoring “spice board”

- Self certified copy of Partnership deed/ Memorandum and Articles of Association as the case may be.

- Self certified copies of GST registration

- Self attested certificate issued by directorate of industries in case of manufacturer-exporter of spices.

- Self certified copy of PAN card

- Passport size photo with white background of CEO or the designated officer of your firm.

PROCEDURE OF SPICE BOARD REGISTRATION

- Step 1: Online Application

- Step 2: Uploading the Documents

- Step 3: Payment of Government Fees

- Step 4: Document Scrutinization by Spices Board

- Step 5: Certificate Issuance of Spice Board Certificate (CRES)

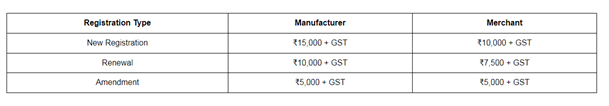

Spices Board Registration Fees

Online Spices Board Registration with Professional Utilities

Any person who is either a Manufacturer Exporter or Merchant Exporter of the 52 scheduled spices and Cardamom must obtain the Certificate of Registration as an Exporter of Spices (CRES) from the Spice Board of India.

There are perks and benefits that only registered exporters receive and it is mandatory to get registered under Spice Board if you are an exporter of the scheduled 52 spices and Cardamom.

You can easily get registered as an exporter of spices by using our fast and hassle free service.